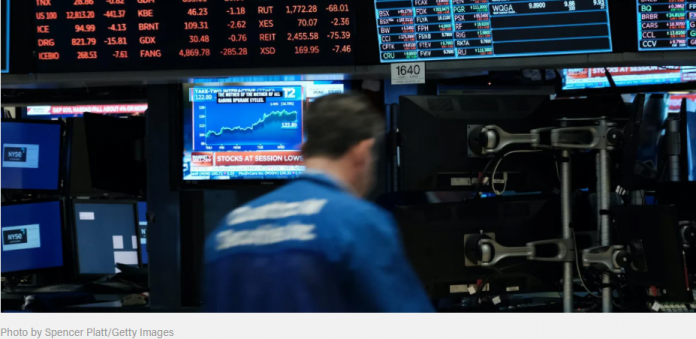

Fears that the economy was going into a recession fueled a stock market drop on the worst day since the pandemic breakout in 2020, as numerous corporations announced bad profits.

The Dow Jones industrial average was down 1,136 points, or 3.5 percent, whilIn a recent poll, voters thought that Biden’s actions are to blame for inflation more than any other factor, including the war of Ukraine, the epidemic, and alleged corporate greed.e the S&P 500 was down 4% and the Nasdaq composite was down 4.6 percent.

The losses on Wednesday increased to investors’ concerns after a month of falling prices.

Retail results triggered the market crash, according to Quincy Krosby, chief equities strategist at LPL Financial.

The capacity of corporations to pass on rising expenses is at the center of today’s broad-based market selloff, which was questioned but found some answers in the retailer’s earnings reports. Consumers continue to spend, but many of the biggest retailers, according to Krosby, are unable to pass on the greater labor expenses and higher prices imposed by a still limited supply chain.

Target was one of them, reporting lower profitability despite higher sales because inflation caused its spending to expand at a faster rate. As a result, Target’s stock has plunged by more than a fourth.

The market also seemed to react to Federal Reserve Chairman Jerome Powell’s statements on Tuesday that the Fed was prepared to raise interest rates further higher to combat inflation.

According to Morgan Stanley, the Biden administration’s excessive fiscal stimulus expenditure was responsible for boosting consumption and inflation.